SMG Private Capital Markets

Many household name companies have received funding from private equity at one point in time. FedEx, Intel and Cisco Systems are all examples that you may recognize. Without the funding, these companies would not be as well-known as they are today.

The relationships between investors, private equity firms and their limited partners have proven to be beneficial for all parties; however, technological innovation changes these relationships and the way firms operate. The use of machine learning disrupts traditional deal structures and improves firms’ deal-sourcing and client interaction abilities.

SMG - The Traditional Way

Traditional methods of investment decision-making for private equity firms are based upon human interaction and meeting potential clients face-to-face. Sourcing deals depends on these connections and the firm’s ability to network effectively.

Following the capital-raising stages, firms use proprietary deal flow, a method of applying connections with the lawyers, accountants and executives of the industry to find investment or buyout opportunities before other competing firms. Joint deals, called syndicates, are also considered if the partnering private equity firm would like to share the profits of the deal whlie mitigating risk & liability. The larger the network of a firm, the more connections it can use to find another company in search of funding or buyout. Following the connection, the firm may analyze the client’s financial and performance data to further understand if an investment would be feasible or not. These concepts are the foundation of private equity and venture capital deal structures.

Traditional methods have been effective for the decades that private equity has been around. They have made name to some of the biggest private equity and venture capital firms in the world, such as Goldman Sachs, Accel and Sequoia Capital. But other than basic financials of a company, how else may a firm use big data to support their investment decisions?

Too Much Data — Is it Good or Bad?

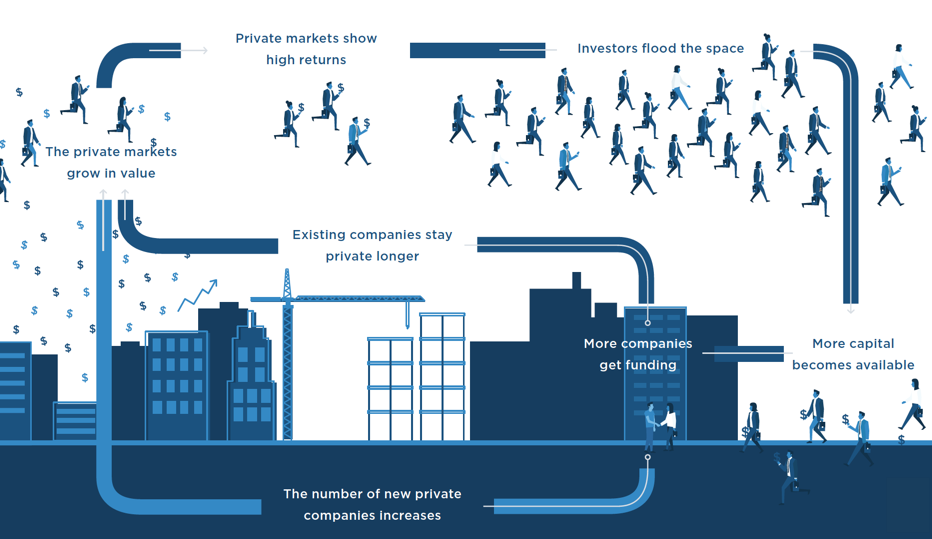

Thousands of businesses enter the market every day. As capital continuously pours into the industry, the decision-making process for private equity firms becomes increasingly difficult.

The abundance of data and crowded markets have created the need for more complex analyses. With the flood of tech startups today, many businesses appear to be almost identical at first glance. The opportunities for investments have increased, but they have come with the challenge of finding the viable ones among the potential failures.

This is why SMG advocates sophisticated software to come in handy. Firm’s need to be able to:

- Analyze companies by the masses

- Process large quantities of data to identify trends, creating clearer graphs that allow for easier comparisons between the startup and the rest of the industry.

- Use the results to determine the startups with the most promising growth potential

— SMG Data Research Team

The Digitized Way

Digitization is showing increased demand as it incorporates itself into the operations of many firms. As time passes and more companies prosper and fail, there is more data for private equity firms to use. As a result, this has led to the increased usage of data analytic driven investments. The private equity industry is a world of risk and payoff, but digitized firms using machine learning technology greatly reduce their risk and reap larger returns from startups growing into large companies.